Guest post by Honey Charnalia

With the advancement of 5G, Fixed Wireless Access (FWA) can provide a cost-effective solution for ultra-high-speed broadband where installing and maintaining fiber may be prohibitively expensive. These FWA networks provide solutions for consumer and enterprise applications in rural, suburban, and other underserved areas.

FWA creates a wireless connection between a Point-of-Presence cell tower and an external antenna located on the customer’s premises to provide service to fixed cellular subscriber units.

The use of FWA has been around for some time. In 1999, 3GPP provided clearly defined requirements, system configurations, and relocation capability for FWA applications (Ref: SP-990121). The evolution of requirements has continued through 3GPP R17 to support features such as FR2 FWA and UE with maximum TRP of 23dbm for band n257, n258, n259. Today, the capability of 5G is expected to rival fiber as it provides high speeds with low latency.

In addition to the FR2 millimeter wavelengths being capable of providing a service bandwidth capacity comparable to fiber, these networks can be deployed quicker and with less expense than those of fiber. Considering that almost 97% of the world’s population now lives within reach of mobile signals, FWA is expected to reduce the digital divide.

FWA Characteristics:

Traffic profile:

- No Intra and Inter RAT mobility

- Reduced signalling

- High throughput

- VoIP vs VoLTE/VoNR

Features:

- Routing behind mobile

- Differentiated QoS for Voice and Video

- Long duration timers

- Low-rate charging

Major Players in FWA:

- Nokia (Finland)

- Verizon Communications Inc. (US)

- Ericsson (Sweden)

- Huawei Technologies Co., Ltd. (China)

- Mimosa Network Inc. (US)

- Siklu Communication (Israel)

- Vodafone (UK)

- Inseego (US)

- Samsung Electronics (South Korea)

- CableFree (UK)

Government grants worldwide:

Studies show that there is a clear correlation between enhanced network penetration and economic growth. As such, governments of leading economies worldwide are pushing connectivity and broadband rollouts through various subsidies and programs. In 2019, the 5G fixed wireless access market was valued at USD 277 million and is projected to reach USD 86,669 million by 2026, a CAGR of 135.9% from 2020 to 2026.

North America:

In 2020 and 2021, the USA launched a series of initiatives with the purpose of making high-speed internet available to the maximum population.

1. Rural Digital Opportunity Fund (RDOF) made available 20.4 billion USD for broadband rollout to unserved and underserved census blocks, with the winners utilizing fiber, FWA, and satellite solutions.

2. Emergency Broadband Benefit was launched during the Covid 19 pandemic to provide USD 50 for broadband access to lower-income families. By mid-2021, 4 million households had benefited from this.

3. Among digital institution investments, E-rate program allocated USD 4.15 billion subsidy to schools and libraries.

Europe:

Europe has a mix of initiatives at local and central level. In 2021, the European Union approved the Recovery and Resiliency Facility for post-Covid 19 economic support. Broadly, National Recovery and Resilience Plans (NRRP)s funded through this facility include initiatives to close the digital divide across four main areas:

- Infrastructure: 5G coverage in populated areas and household gigabit connectivity

- Digital skills: aimed at adults with basic digital skills, and ICT specialists

- Digitalization in public services: online services availability, e-medical records, and e-IDs

- Business digitalization: aimed at improving SME basic digital intensity and cloud usage.

Norway encourages network connectivity through its Haga model and the district development model.

Australia:

The Australian government is promoting connectivity through its National Broadband Network.

Movement in the industry

Market drivers:

Rising adoption of latest devices based on technologies like machine-to-machine communication (M2M) and Internet of Things (IoT) such as smart meters, smart streetlights, livestock monitoring devices, and smart parking systems, along with the implementation of millimeter-wave technology for FWA, are expected to strengthen the FWA market.

Telematics, Telemetrics, consumer electronics, supervisory control and data acquisition (SCADA), point-of-sale (POS), fleet management solutions and advanced metering infrastructures (AMIs) are other compelling use cases for 5G FWA.

Some major use cases of 5G FWA:

Telematics: – Telematics in general refers to the method of monitoring vehicles, equipment, and other assets by using GPS technology and on-board diagnostics (OBD) to plot a detailed computerized map showing the information about assets’ movements.

Telemetrics: – Telemetrics simply means the process of collecting information of objects that are far away and sending them somewhere electronically.

Consumer Electronics: – As consumer-based technology evolves, so does the demand for high-speed connectivity to accommodate new consumer applications. Here, 5G FWA plays a significant role for the betterment of this use case.

Supervisory Control and Data Acquisition (SCADA): – A control system architecture comprising computers, networked data communications and graphical user interfaces for high-level supervision of machines and processes. It also includes sensors and other devices, such as programmable logic controllers.

Point-of-Sale (POS): – Refers to the place where a customer executes the payment for goods or services and where sales taxes could be paid. It can be in a physical store, where POS terminals and systems are used to process card payments, or a virtual sales point such as a computer or mobile electronic device.

Fleet Management Solutions: – Defined as the processes followed by fleet managers to monitor fleet activities and make decisions from asset management, dispatch and routing, and vehicle acquisition and disposal.

Challenges facing FWA implementation:

One of the major challenges that mmWave spectrum faces is the high manufacturing costs, as these components are tiny and require high precision. Another challenge is signal loss and range reduction due to the blocking of mmWaves by large objects such as trees and buildings. This leads operators to install more towers and equipment. Higher transmitting power can be used to boost the signal range, which results in greater fuel consumption and increased radiation. Moreover, erection of towers needs space which is created by heavy deforestation in rural areas. Toxic raw materials such as SiGe, GaAs, InP and GaN utilized in mmWave frequency circuits can be a health hazard especially over prolonged exposure. The impact is expected to grow further with greater implementation of the millimeter-wave technology in the future.

All these restraints can lead to a negative sentiment against the adoption of 5G FWA by the rest of the world.

FWA architecture:

FWA architecture is similar to a common 3GPP architecture used along with fixed cellular subscriber units, known as FWA terminals, to provide ultra-high-speed broadband services. Similar to initial 5GNR NSA deployments, FWA also uses a classic 4G EPC Evolved Packet Core infrastructure for transporting data and controlling information. EN-DC Option 3x, the new gNB’s supporting FWA and other early 5G deployments, operate in a Non-Standalone (NSA) manner to support existing 4G eNodeB/EPC. This option 3x helped to reduce the deployment risks and variables during the first implementation of 5G FWA.

Over the course of time, the adoption of a complete 5G SA Service Based Architecture (SBA) can be simplified dramatically. As we cannot completely eradicate the 4G Core, a 4G/5G Control Plane Interworking Function (CP-IWF) implemented northbound of the Mobility Management Entity (MME) would complete this approach to enable existing LTE mobile users to exploit the 5G Core infrastructure as well as FWA subscribers.

Differences between 4G and 5G:

Final thoughts:

There is a large digital divide between areas with readily available high-speed broadband and underserved markets. The pandemic not only highlighted this divide, but also amplified the need for networks that enable distance learning and working from home in these underserved areas.

Fixed Wireless Access (FWA) has been around for some time, but with a greater need to bridge the divide and the promises of 5G, these applications are on the cusp of becoming more ubiquitous.

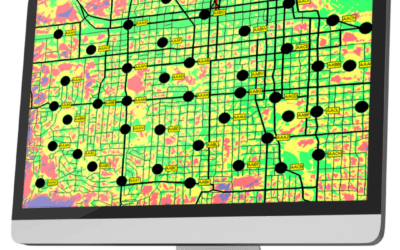

We at EDX Wireless understand this situation very well and have aligned our network planning tools to support the FWA use case in your 4G/5G planning requirements. Based on industry standards and enhanced with customizable features and automated processes, EDX is built to support 5G NR networks in any stage of the system life cycle and ensure you meet performance and budgetary requirements. Schedule a demo to see how EDX tools will change the way you plan 5G NR and more.

EDX provides a complete solution for the design and deployment of Fixed Wireless Access:

Spectrum & Capacity

With the 3GPP standards of 20gbps and 1ms latency in 5GNR along with the higher frequencies used in these applications, a greater-detailed system design is necessary to ensure standards, and therefore the service consumers’ demand, are met.

- Support for Low (Sub 1GHz), Mid (1-6GHz) and mmWave (24-40GHz) bands.

- Model MIMO and Massive MIMO configurations and directionality to minimize. interference and ensure service and latency requirements are met.

- Analyze Carrier Aggregation across different devices and traffic scenarios for any region.

Coverage

- Model coverage for different CPE types and mounting locations – both indoor and outdoor.

- Plot SINR, RSRP, downlink/uplink throughput, aggregated Carrier Count, received power and other technology specific studies on your coverage map.

- Use Novus to upload projects into the cloud and view on a flexible interface. The application provides a user dashboard that stores historical project data and allows you to export and share projects with customers or others in your organization.

Site Analysis

- Import your site information and run various scenarios based on equipment, CPEs, MIMO configurations and more to ensure cost and coverage requirements are met.

- Analyze Macro Site vs Small Cell in urban vs rural deployments in varying population densities to determine the percentage of customer base served by each site configuration.

- Ensure a positive ROI by determining the number of consumers that will be served by a site with the costs of deploying on that site.

Data

EDX provides all the data needed to accurately model service areas of any size for any region in the world.

- Clutter data up to 1m resolution

- 2.5D Clutter Heights

- 3D buildings

Usage-Based Licensing

EDX provides project-based licensing for flexibility of use. With a variety of ways to license the software, find the solution that best fits your needs, from short-term opportunities and RFP responses to long-term needs.

Further Research

1. 3gpp SP-99012, R4-20XXXX draft CR for FR2 FWA RF requirements_QC,

2. The FWA handbook 2021 by Ericsson.

5. https://www.marketsandmarkets.com/Market-Reports/5g-fixed-wireless-access-market-41266711.html

6. https://www.metaswitch.com/knowledge-center/reference/what-is-5g-fixed-wireless-access-fwa#:~:text=Fixed%20Wireless%20Access%20(FWA)%20enables,expensive%20to%20lay%20and%20maintain.

References:

1. 3gpp SP-99012, R4-20XXXX draft CR for FR2 FWA RF requirements_QC,